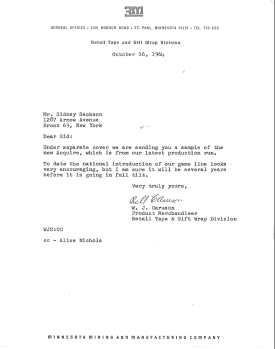

There was no correspondence for two and a half months. Then there was a letter from Caruson on October 16th.

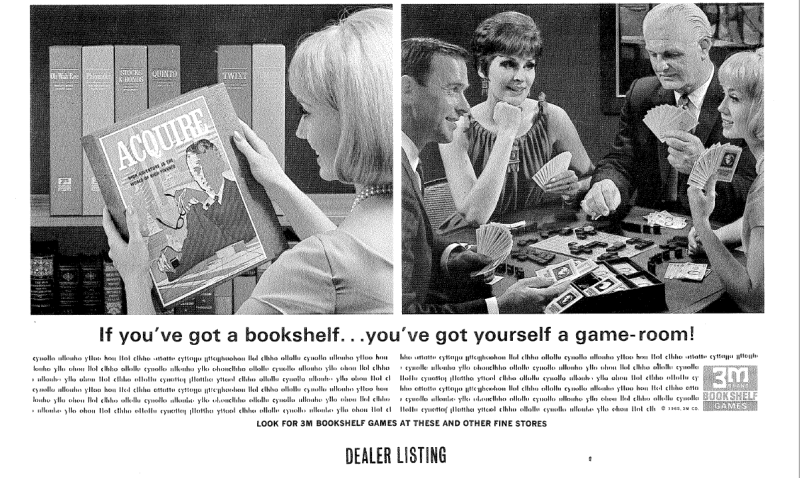

“Under separate cover we are sending you a sample of the new ACQUIRE, which is from our latest production run. To date the national introduction of our game line looks very encouraging, but I am sure it will be several years before it is going in full tilt.”

It would be interesting to know when the game of ACQUIRE actually reached “full tilt.” This next diary entry on October 20 is a very interesting insight into Sid Sackson.

“(Received) check for $818.59 for 3rd quarter from 3M for ACQUIRE.”

This is the first diary entry by Sid since January that references his payments from 3M. In January he stated that he was disappointed with the statement. Yet he received $51.49 for only one month of sales. The entire first quarter of 1964 he only received $57.37 for three months. Then the second quarter of 1964 completely plummeted to a 5% royalty of $9.59 for three months of sales. Now Sid receives a check for the third quarter of 1964 for $818.59, or the equivalent of $6,700 in today’s dollars, and all he does is write a matter of fact sentence in his diary.

Sid writes in his diary on October 22nd, “(Received) the new edition of ACQUIRE from 3M. They added the points I wrote about but kept the rules very brief. They changed the prices too, upping them on most of the chains.”

3M was listening to Sid to a degree. They cleaned up one of the three rules like he asked. Yet now that he received the game, and not just the very condensed rules, he could see that they raised the stock prices. His idea was to have all the prices the same starting at $200 per share. 3M staggered the pricing to $200, $300, and $400. Since 3M had made it so all the hotels have the same amount of stocks, this must have been their arbitrary way to counter act that move. No staggered stocks to save money on printing, we’ll just stagger the price. Should be the same difference, right?

It is interesting that Sid commented on this in his diary, but only off offhandedly commented about the non-staggered stocks earlier in a letter to Caruson. Since 3M was hell bent on saving production costs over increasing dynamics in this game, at least this arbitrary thought added some strategy back into the game.

On October 31st Sid writes in his diary, “Played ACQUIRE (new rules) with Renee & Jack Clark. Worked well. Renee won.”

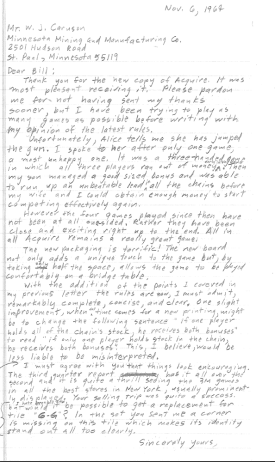

Then on November 6th Sid wrote a letter to Caruson.

“Unfortunately, Alice tells me she has jumped the gun. I spoke to her after only one game, a most unhappy one. It was a three-handed game in which all three player ran out of money early in the game. Then my son managed a good size bonus and was able to run up an unbeatable lead in all the chains before my wife and I could obtain enough money to start competing effectively again. With the addition of the points I covered in my last letter the rules are now, I must admit, remarkably complete, concise, and clear.”

It has to be wondered if Sid is being facetious in his comment about the rules. Considering 3M produced the rules as “bare bones” as they can, and they only fixed one out of three of Sid’s requests, they are not as Sid says, ”remarkably complete, concise, and clear."

This letter reveals the need for a rule of strategy that should have been added in the final production of ACQUIRE. This is the time in the game that makes trading of stocks necessary. The inevitability of a player running out of money is the normal course for the game of ACQUIRE. It is at this point that a player needs a way to stay in the game or they might as well just “fold.”

To make this game more exiting and competitive, players need a way to generate money when they have none.v If the 2-for-1 method of trading stocks had been eliminated, then players could be allowed to trade stocks when they are out of money in order to obtain the three shares of stock they desire on their turn. The rule would allow the game of ACQUIRE to better utilize logical thinking.

In the stock market, if a person has invested in a company that they no longer wish to retain ownership in, they can sell those stocks. This allows the investor to speculate and profit off of companies that grow quickly by purchasing the stocks when they are at a low price and selling them when they are at a higher price or just getting their money back to invest elsewhere. If this rule had been adopted in the game of ACQUIRE, players would not be tasked with the threat of being stuck with stocks that do not benefit their quest to win the game. It allows them to try to stay in the game while other players have money.

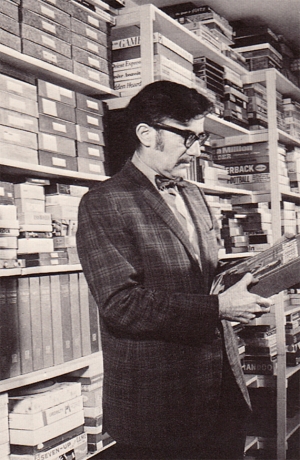

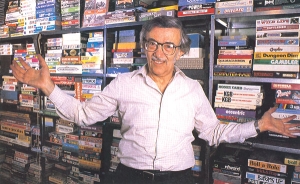

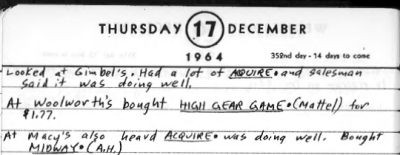

The last diary entry in 1964 concerning ACQUIRE reads, “Looked at Gimbels. Had a lot of ACQUIRE and salesman said it was doing well.”

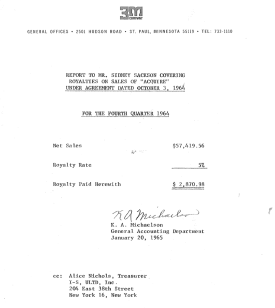

The fourth quarter report for 1964 shows sales of $57,419.56 with Sid’s 5% at $2,870.98, or in today’s money, $23,578.50. The game of ACQUIRE was “doing well.”

Even today the game of ACQUIRE should be “doing fantastic.” ACQUIRE should be more popular than MONOPOLY and should be on the tongues of everyone as the best game ever. The year of 1964 was the pivotal year for creating the difference between something great or something real good. Here we are, 60 years later with versions of ACQUIRE that still play the same as this first mass production model with no hope of creative change in the future. Corporate has truly taken individual creativity hostage.

© 2020 Lloyd T. Solon

Continue on to read about the 3M Era of ACQUIRE →